Medicare Supplement Plans

Medicare Supplement plans, sold by private insurance companies, can help pay some of the remaining Original Medicare health care costs, like deductibles, copayments, and coinsurance. Medicare Supplement plans are also called Medigap plans. Some Medigap plans also offer coverage for services that Original Medicare doesn't cover, like emergency medical care when you travel outside the U.S. Medigap plans are only required to cover the benefits and services Original Medicare covers.

Medigap policies are standardized

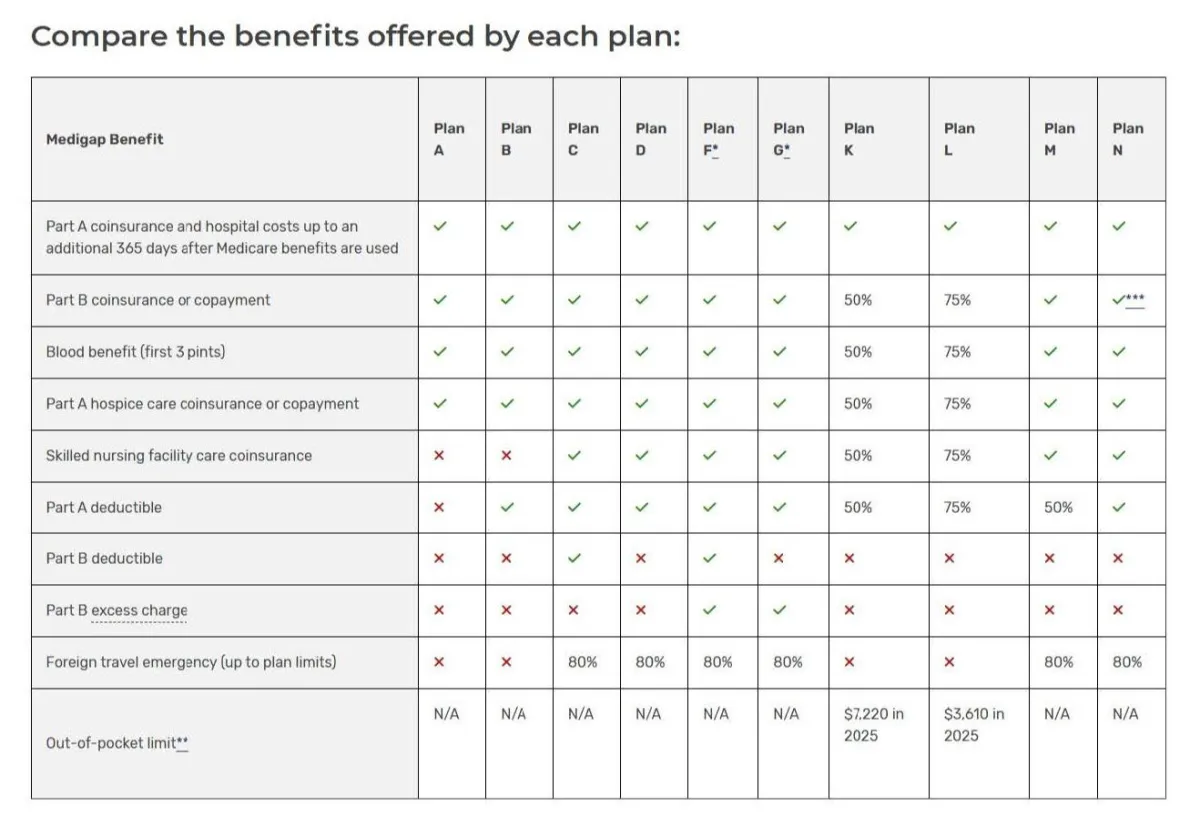

Medigap plans are subject to state and federal regulations. As of June 2010, insurance companies can sell you only a "standardized" policy. Plans are identified by letters A, B, C, D, F, G, K, L, M, N and are offered by private insurance companies. (Not all plans are offered in all states or by all insurance companies.) Standardized means that all of the policies offer the same benefits for each plan letter, but each plan letter provides different coverage. Although the policies have the same benefit structures per plan letter, the insurance companies can charge different premiums based on age, gender, zip code, tobacco use, weight and medical conditions.

Starting January 1, 2020, Medigap plans sold to people new to Medicare won’t be allowed to cover the Part B deductible. Because of this, Plans C and F will no longer be available to people who are new to Medicare on or after January 1, 2020.

If you already have either of these two plans (or the high deductible version of Plan F) or are covered by one of these plans prior to January 1, 2020, you'll be able to keep your plan. If you were eligible for Medicare before January 1, 2020 but not yet enrolled, you may be able to buy one of these plans.

People new to Medicare are those who turn 65 on or after January 1, 2020, and those who get Medicare Part A (Hospital Insurance) on or after January 1, 2020.

Comparing Medigap policies

The chart below shows basic information about the different benefits that Medigap plans cover. If a percentage appears, the Medigap plan covers that percentage of the benefit, and you are responsible for the rest.

Which Medigap Plans Can I Choose From?

Get a Consultation

& Quote at No Cost

Senior Benefits NorthWest Copyright 2025 -- All Rights Reserved

Phone: (503) 724-0529 Email: blair@seniorbenefitsnw.com